Queensland's First Home Owners' Grant & Stamp Duty Rebate

When buying your first home in Queensland, the government offers two different grants or rebates. These are the QLD First Home Buyers Grant and the QLD Stamp Duty Rebate. If you are able to claim both in full, you are getting $28,750 in total from the Queensland government to go towards your home.

QLD First Home Owners’ Grant

The Queensland First Home Owners’ Grant is an initiative set up by the government to help first home buyers get their new home sooner. This is a great opportunity for young people to buy or build in the state of Queensland!

The closing date for the $20,000 grant is now 30th June 2018. However, if your contract to build or buy is signed between 1st July 2016 and 30th June 2018, you may still be eligible to apply for the $20,000.

The new Queensland First Home Owners’ Grant will be $15,000. This could be what helps you afford that little bit extra or get you into your first home sooner. To be eligible for the grant you must be an Australian citizen or applying with someone who is, must not have previously owned property in Australia, at least 18 years of age and buying a brand-new home, valued under $750,000.

Frequently Asked Questions

When is it paid?

If you are building, the grant will be paid when the slab is poured or when construction has started. If you are buying a home, the grant will be paid at settlement.

Can I use the grant as part of my deposit?

Yes, definitely!

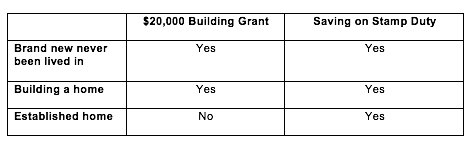

What grants and rebates am I eligible for as a first time home builder?

QLD Stamp Duty Rebate

The QLD government has decided to help first home buyers by giving them a rebate on all or part of the cost of the stamp duty because It can be quite a substantial additional cost when buying a property.

Stamp duty on a property is similar to the vehicle stamp duty you pay when registering if you are buying a car. It is a tax paid by the buyer of a property and is paid when buying an established home or vacant land. It also changes depending on the value of the property.

Frequently Asked Questions

How do I maximise my entitlement to the Stamp Duty Rebate?

The stamp duty rebates are different depending on whether you are buying an established dwelling or vacant land. If you are buying an established home valued for under $500,000 you can apply for up to $8,750 or up to $7,175 if you’re buying a block of vacant land for under $250,000. The rebate increases the more you pay for your property, up to the capped amount. You can claim the maximum rebate ($8,750) if the cost of your property is $499,999, or you can claim a maximum amount of $7,175 if you spend $249,999 on a block of vacant land.

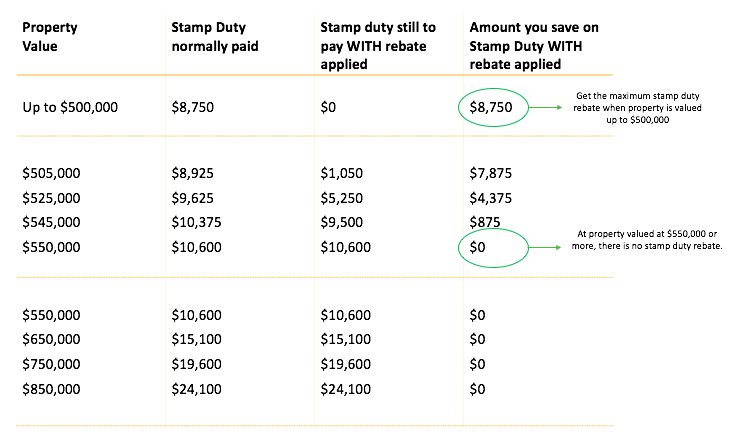

How much do I save when receiving the Stamp Duty Rebate if I buy an existing dwelling?

The amount you get in rebate differs depending on the price of the property you are buying. For example, properties valued up to $500,000 can get the maximum rebate you can receive. Properties valued between $500,000 to $550,000 will still have stamp duty to pay but the reduction in costs is at a reduced rate. Once the purchase price is $550,000 or higher, the first home buyer rebate cuts out so you’ll be charged the same stamp duty as you would if you were buying a home as a normal owner occupier.

See the table below to see how much you save on stamp duty with the rebate applied:

What is the eligibility criteria to get the Stamp Duty Rebate?

To be eligible for the Stamp Duty Rebate you must:

1. Have had no previous ownership of residential land/property

- · Have never held an interest in residential land anywhere in the world

- · Have never claimed the first home vacant land concession

- · Have never owned or part owned any property in the past

If you are buying with someone who has owned property before, you can only claim 50% of the rebate which is your portion.

2. Live in the property for at least 12 months

· You must live in the property for a period of at least 12 consecutive months, commencing within 12 months of the purchase.

· If you don’t, you will be required to pay back either part or all of your rebate.

3. Age and Citizenship

· You must be at least 18 years old

· Permanent resident in Australia / Australian citizen. If you aren’t, you are still eligible for the concession, however there is an additional levy payable called the Additional Foreign Acquirer Duty (AFAD) which is levied at 3% of the purchase price.

Source:

https://www.blackk.com.au/first-home-loans/qld-stamp-duty-rebate-qld-complete-guide/

https://www.blackk.com.au/mortgage-broker-brisbane/first-home-buyers-grant-qlds-comprehensive-guide/